A massive $16.4 billion proposed coal mine has sparked protests and a heated debate. As the Adani project becomes a symbol of Australia’s future, The Wire examines the issues at stake.

Stop Adani billboard in Brisbane. Credit: Kabir Agarwal

Note: This is the first in a five-part series that will examine how the Adani and Carmichael coal mine has divided the Australian public and in the process, sparked fierce debate on issues such as coal-based energy, energy financing, jobs and the rights of indigenous people.

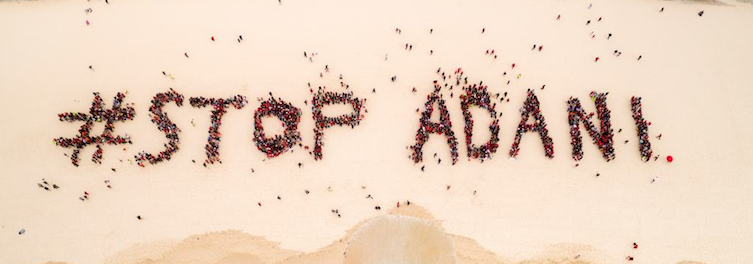

On October 7, 2017, an estimated 16,000 people at 45 different locations across Australia came together to stage the biggest protest yet against the Carmichael coal mine.

The protesters, who had gathered at several strategic locations around Australia, such as the iconic Bondi beach in Sydney, organised into formations to spell out their demand, literally – ‘STOP ADANI’.

The Carmichael coal mine, proposed by the multi-billion-dollar Adani group, has seen protests across Australia for the last few years. The protests particularly gathering momentum in the last one year. Most of the ire has been directed at Gautam Adani, chairman of the Adani group. Aided by the unambiguously named ‘Stop Adani Alliance’, a coalition of over thirty organisations that has steered the protests, Adani has become a household name in much of Australia in ways he would probably describe as unflattering.

Earrings, caps, t-shirts, socks and bandanas with the words ‘Stop Adani’ printed on them have become more common than one would imagine on the streets in Australia. Creative videos have been put together expressing strong displeasure with the mine and Adani. Artists have written and performed songs highlighting the dangers that the mine poses and the importance of speaking out against it. Graffiti on streets and in public toilets convey an adverse and contemptuous view of Adani’s efforts to mine coal in Australia. Pictures of Adani on massive billboards accompanied by words such as ‘destruction’ and ‘exploitation’ can be seen at prominent places in cities.

Adani’s proposed coal mine — which, if and when complete, would be the largest in Australia and among the largest in the world — has brought people together into a sustained mass movement with the kind of intensity previously unseen in Australia. The results of a survey of 2,194 residents across Australia conducted on October 4 showed that 55.6% of those surveyed were opposed to the Adani coal mine, with only 26.1% being in favour and the rest being undecided.

Mine, coal terminal and rail-link

The Adani group’s tryst with the Carmichael coal mine began in August 2010 when the group bought the Australian energy company Linc Energy’s Galilee basin coal tenements for a total of A$ 680 million. The initial deal involved a cash plus royalties agreement. Subsequently, in 2014, the Adani group bought-out the royalty rights. The coal tenements, estimated to contain 7.8 billion tonnes of coal, are located in Central Queensland’s untapped Galilee basin. Later that year, in October, Adani Mining Private Limited, a subsidiary of Adani group’s flagship entity, Adani Enterprises, made the official proposal for the ‘Carmichael coal mine and rail project’ through an ‘Initial Advice Statement’ filed with the government of Queensland. The proposal outlined plans for building a greenfield coal mine involving both open-cut and underground mining. The Adani group, at the time, estimated that the mine would require a capital investment of $4.1 billion for the construction of the mine and $16.4 billion for mine operations. According to the proposal, 2014 was to be the first year of production and it prophesied that peak production of 60 million tonnes per annum of coal production would be reached in 2022.

Meanwhile, in May 2011, the Adani group acquired Queensland’s Abbot Point coal terminal for $1.98 billion from the government of Queensland on a 99-year lease. Since the Adani group planned to export most of the coal from the Carmichael coal mine to India for use in Adani Power’s power plants, this was a crucial acquisition. The Carmichael coal mine is located in remote Central Queensland, approximately 300 kilometres inland. The Adani group has also proposed a 388-kilometre rail link connecting the mine to the port, in keeping with its pit-to-plug strategy.

The ‘Carmichael Coal mine and rail project’ was declared a ‘significant project’ in November 2010 by the Queensland government, implying that the project needed to undergo a comprehensive environment impact assessment. The Adani group received the terms of reference for the Environment Impact Statement (EIS) in May 2011, and then began a lengthy process of documentation, approvals and court tussles, owing to cases filed by environmentalists and land owners against the proposed mine. Finally, the mining lease was issued in April 2016.

During this time, much occurred that went against the interests of the Adani group’s Carmichael mine project. Coal prices fell from $90 a tonne in August 2010 to $52 a tonne in September 2016, raising questions about the financial viability of the mine. India’s coal imports peaked in 2014-15 at 217 million tonnes, and then fell to 204 million tonnes in 2015-16, falling even more in the subsequent year. During this period, Piyush Goyal, the then Union minister for power, coal, new and renewable energy, announced the government’s intention to stop the import of coal, further denting the Carmichael coal mine’s prospects. Solar energy prices fell drastically to be almost at par with coal prices. As many as eleven major international banks refused to fund the project as pressure grew on Australian banks to follow suit.

The human formation in Bondi beach in Sydney on October 7. Credit: StopAdaniAlliance.

These factors led the Adani group to scale down the size of the mine significantly from the initially proposed investment of $16.4 billion to $4.2 billion. Production was also to be curtailed at 25 million tonnes of coal per annum in the first phase of operations, instead of the initially proposed 60 million tonnes at peak production. The Adani group had been forced to trim its mine to a fourth of its original size. All was not going according to plan for the Adani group’s flagship investment in Australia.

From its very inception, the Adani coal mine has faced stiff opposition in Australia, with the size of the opposition and intensity of the protests gradually growing. The issue has captured imaginations and fuelled debates to an extent that over the last one year, it has been one of the main issues dominating headlines in Australia and is expected to be one of the core issues in the Queensland state elections due to be held before May 2018.

Environmental concerns

The opposition to the Carmichael mine has revolved significantly around the potential damage that the mine could cause to the Great Barrier Reef due to its climate change impact and dredging of the seabed near the reef. The project involves dredging of 1.1 million cubic metres of seabed near the Great Barrier Reef marine park and experts have argued that this will damage the reef in that area ominously.

On the climate change front, it is estimated that, if built, the mine would generate 4.7 billion tonnes of greenhouse gas emissions from the mining and burning of coal, using up more than 0.5 percent of the global carbon budget to limit global temperature rise below two degree celsius above pre-industrial levels as agreed in the Paris climate agreement.

Another cause for concern is the Queensland government’s decision in March this year to grant Adani Mining unrestricted license for sixty years to use groundwater from the Great Artesian basin for the purpose of the mine. The Great Artesian basin is one of the largest underground fresh-water reservoirs in the world and is the only reliable source of fresh water supply for large parts of Northern Territory, Queensland, New South Wales and South Australia. It is estimated that the Carmichael coal mine could use as much as 26 million litres of water a day from the basin and this has caused farmers and graziers in the area to grow concerned about the future of their source of fresh water supply. The awarded license candidly acknowledges that the use of water from the basin will have an impact on groundwater levels in the region during the life of the mine and for a period after. Some experts have argued that the impact of the groundwater draining will be irreversible.

Opposition from traditional owners of the land

The Wangan and Jagalingou (W&J) people are the traditional owners of the land on which the Adani group has proposed to build its mine and they argue that if this mine was to be built on their homelands, it would irreversibly destroy their customs, culture and heritage. The W&J people lodged a ‘native title claim’ on approximately 30,000 square kilometres of land in Central Queensland in 2004. The mine is to be built on parts of this land. In Australia, native title law is a recognition that ‘some indigenous people continue to hold rights to their land and waters, which come from their traditional laws and customs’.

For the mine to proceed, the Adani group needs to secure the consent of the W&J people through an indigenous land use agreement. The Adani group has tried several times to negotiate with the W&J people but has failed to secure consent of all twelve families in the W&J claim group. In April, when the Australian Prime Minister Malcolm Turnbull was in New Delhi with Adani’s mine high on the agenda, he assured Gautam Adani in a private meeting that the native title issues will be ‘fixed’.

The Wangan and Jagalingou Traditional Owners Family Council is at the forefront of the tussle with the Adani group and have taken the matter to the federal court of Australia. The matter is up for hearing in March 2018 and is being seen as the last legal hurdle in the way of the Carmichael coal mine.

Carmichael coal project in Australia. Credit: Reuters

Concerns over financial viability

The Adani group had deferred its ‘final investment decision’ on the Carmichael project several times, and it was only in June that a ‘green light’ was given to the project. However, some have argued that the investment decision was meaningless as the Adani group was yet to secure financing for the project. As many as twenty-four banks globally that the group has approached for finances have either refused funding the project or have introduced rules that would make the Carmichael project out-of-bounds for them.

In addition, the project is precariously placed in terms of financial viability due to volatility of coal prices, and the forecast of a saturated global coal market. In addition, analysts have argued that since the Carmichael coal is low in energy content and high in ash content, the coal is likely to be sold at a significant discount, making it even more difficult for the project to achieve a break-even point.

On October 6, Chief Executive Officer (CEO) of Adani Australia, Jeyakumar Janakaraj, admitted in an interview that the Adani group still needs to tie-up $4.2 billion (AUD) in finance for the Carmichael mine and rail project. The Adani group has set a deadline of March 2018 to tie up funding for the project. Previously, the deadline was December, 2017.

A recent report has claimed that Adani’s Abbot point port terminal is critically dependent on the Carmichael mine project going ahead as the port is currently only operating at 50% of its capacity and most of its ‘take-or-pay’ contracts, which currently earn revenue for the port, expire soon. To add to the woes, the Adani group will need to refinance A$1.48 billion of debt on its port by November 2018 and a cumulative debt refinancing of A$2.11 billion by 2020. According to the report, in order for the Adani group to secure the refinancing it will have to ‘convince financiers that [Abbot Point] will be fully utilised into the future’, for which, in turn, it needs the Carmichael mine to go ahead and potentially use the port to ship coal out.

The billion-dollar government subsidy

Owing to difficulties that the project has faced in obtaining finance from private lenders, the future of the Adani group’s Carmichael coal mine now critically depends on the prospect of receiving from the Northern Australia Infrastructure Facility (NAIF) a concessional A$ 900 million loan for the rail link from the mine to the port. The NAIF was set up by the government of Australia in 2016 to ‘encourage and complement private sector investment in infrastructure that benefits northern Australia’.

In July, Reuters reported that the Adani group’s project was among the five that have been shortlisted by the NAIF for government funding out of 124 loan applications. However, citizens have opposed the prospective government funding arguing that this would amount to ‘a bail out’. According to the survey quoted earlier, 66% percent respondents believed that ‘the government should not spend public funds on Adani’s private rail line for their coal mine’. Environmental activists have questioned the wisdom of spending tax payer’s money on a coal mine which would be among the largest in the world at a time when the world is moving rapidly away from coal.

The NAIF is expected to make a final decision on funding the rail-link not before the end of the year.

Gautam Adani. Credit: Reuters

The promise of jobs

In 2013, Adani Australia claimed in a television commercial that the Carmichael coal mine and rail project would bring 10,000 jobs to Queensland. Most of the jobs, it was projected, would be created in northern Queensland — a region suffering severe unemployment.

In January 2015, appearing before the Queensland land court on behalf of Adani Mining private limited, Jerome Fahrer, an economist formerly with the Reserve Bank of Australia, testified that the project will result in 1,464 net jobs. He estimated the figure on the basis of complex economic modelling which factored in job losses in other industries such as mining, manufacturing and agriculture.

Despite Fahrer’s testimony, the Adani group has stuck to the figure of 10,000 jobs. Even the Australian Prime Minister Malcolm Turnbull has publicly forecast that the mine will create ‘tens of thousands’ of jobs.

Political support

The Adani group’s coal mine has largely received strong support from the Labour party-led Queensland state government and the Liberal-National coalition led Australian government. Though the two formations are rivals in the political field, they have supported the development of the Adani group’s coal mine. In fact, in March, Annastacia Palaszczuk, the Premier (head of government) of Queensland paid a visit to Adani’s Mundra port and met Gautam Adani to ‘show support’ to the project. A month later, Turnbull, on a visit to India, met Gautam Adani and at a private meeting, assured him that outstanding issues will be fixed. At a press conference, Turnbull spoke about the jobs and revenue that the mine will bring to Australia.

In Australia, politicians have been grilled about the negative impacts of the mine on the climate. Some have responded by saying that the emissions of Australia will not be impacted as the coal will not be burnt in Australia. Further, the argument has been that millions of people in India are without electricity and that this mine will help them gain access to it – the kind of argument that the author Anna Krien, in her recent book, The Long Goodbye, referred to as ‘the modern origin story of coal evangelism’.

Kabir Agarwal is an independent journalist whose writings have appeared in The Kashmir Walla, The Times of India, Mint, Al Jazeera English and The Caravan. He can be found on twitter @kabira_tweeting.

Comments are closed.